TYLER, Texas — During this year's legislative session, bills were passed that require changes to our Texas Constitution, hence the constitutional amendments.

Understanding the language of what’s proposed isn’t always easy. Here’s a look at key terms for each proposition to help you know what you’re voting on.

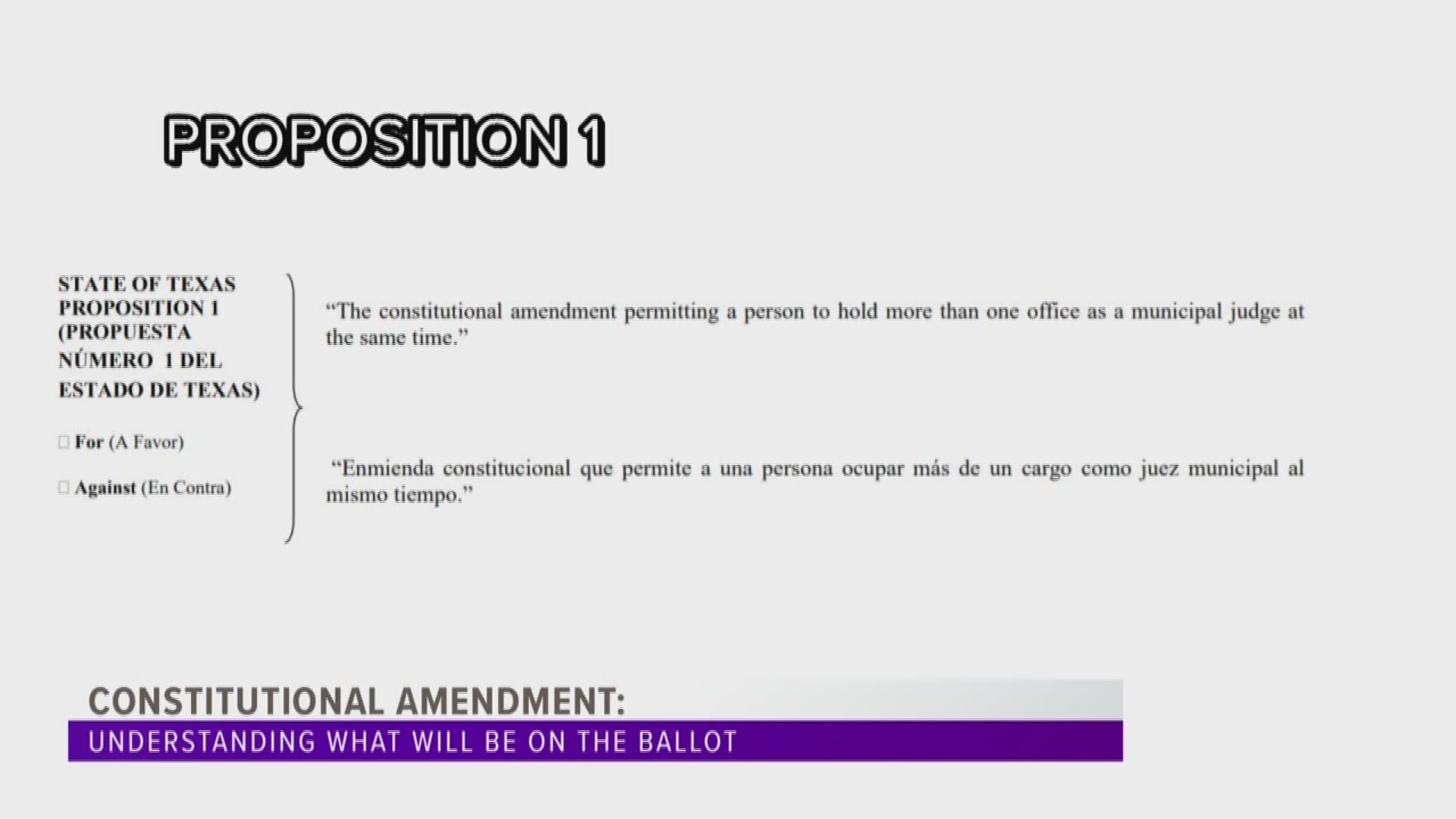

Proposition 1

“The constitutional amendment permitting a person to hold more than one office as a municipal judge at the same time.”

It mentions a person holding more than one office as a municipal judge.

If you vote yes, you're saying one city's judge can work for another city as their judge as well. Some people say this gives smaller towns the ability to have the best possible judge.

Proposition 2

“The constitutional amendment providing for the issuance of additional general obligation bonds by the Texas Water Development Board in an amount not to exceed $200 million to provide financial assistance for the development of certain projects in economically distressed areas.”

The issuance of bonds for financial assistance in economically distressed areas. This means, the Texas Water Development Board, TWDB, can use bonds to pay for water and wastewater infrastructure projects in impoverished areas. Those against this proposition, argue if TWDB needs more money it should figure that out during the budget process and not put this back on the taxpayers.

Proposition 3

“The constitutional amendment authorizing the legislature to provide for a temporary exemption from ad valorem taxation of a portion of the appraised value of certain property damaged by a disaster.”

A temporary exemption of taxation of certain property damaged by a disaster.

This would allow the Texas Legislature to create temporary property tax exemptions for people whose property was damaged in governor-declared disaster areas.

Proposition 4

“The constitutional amendment prohibiting the imposition of an individual income tax, including a tax on an individual’s share of partnership and unincorporated association income.”

Prohibiting the imposition of an individual income tax, including a tax on an individual’s share of partnership and unincorporated association income.

This is not a vote about creating a state income tax. This is about making it harder to do so.

Proposition 5

“The constitutional amendment dedicating the revenue received from the existing state sales and use taxes that are imposed on sporting goods to the Texas Parks and Wildlife Department and the Texas Historical Commission to protect Texas’ natural areas, water quality, and history by acquiring, managing, and improving state and local parks and historic sites while not increasing the rate of the state sales and use taxes.”

It's to take state sales and use taxes on sporting goods to use that money for State parks, the Wildlife Department and the Historical Commission.

Proposition 6

“The constitutional amendment authorizing the legislature to increase by $3 billion the maximum bond amount authorized for the Cancer Prevention and Research Institute of Texas.”

This authorizes an increase the research of cancer. If you vote yes, you're allowing the legislature to double the funding for the Cancer Prevention and Research Institute of Texas to $6 million.

Proposition 7

“The constitutional amendment allowing increased distributions to the available school fund.”

It would double the amount of revenue provided for classroom materials and funding for Texas schools.

Proposition 8

“The constitutional amendment providing for the creation of the flood infrastructure fund to assist in the financing of drainage, flood mitigation, and flood control projects.”

This creates a flood infrastructure fund to finance projects after a disaster.

Proposition 9

“The constitutional amendment authorizing the legislature to exempt from ad valorem taxation precious metal held in a precious metal depository located in this state.”

Exempts from taxation precious metal held in a metal depository in the state.

This allows the Legislature to create a property tax exemption for precious metals in state depositories.

Proposition 10

“The constitutional amendment to allow the transfer of a law enforcement animal to a qualified caretaker in certain circumstances.”

Retired law enforcement animals would be able to be adopted without a fee.